10 Steps to Streamline Your Month End Close Process Bench Accounting

Content

- Additional Checklist for Year-End Closing

- How to prepare for a smooth month end close process

- How long should the month-end close process take?

- Expert Accounting Tips For Scaling Ecommerce

- How to Get Procurement & Finance to Collaborate Well

- Automate Repetitive Tasks in Your Month-End Close Process

- Why is the month-end close important?

An accounting procedure followed by accountant at the end of every month to close the accounting records of current accounting month. Closing indicates that no entries will be posted in the closed period.

There is no set month-end close timeline as it varies by organization, but by taking stock of the required monthly activities for your team in advance, you can block off the necessary time and be prepared. Business decisions cannot be made without accurate financial statements. And, accurate financial statements cannot be procured without a timely and repeatable month end close process. A month end close process flowchart can help to keep your month end close process running smoothly. Month-end close requires accurate and organized financial statements, including your general ledger, balance sheet, and profit/loss statement.

Additional Checklist for Year-End Closing

Transform your accounts receivable processes with intelligent AR automation that delivers value across your business. There will likely be various tools and systems involved, especially because of the sheer amount of data required for the account close process. This way, you can cut the time it takes to perform account reconciliations down dramatically because the process becomes automated. Removing the manual process of account reconciliation will result in reduced human error, time savings, and, in turn, cost savings. Create a deadline to complete your closing procedures, depending on your business and your team’s workload. If you’re fighting for time, aim to catch up with your reconciliation ahead of the month end close process.

- Cisco Webex Teams are other available options as team collaboration tools.

- So, how can you simplify your responsibility of closing your books monthly?

- Due to the amount of moving parts and data required to perform the month end close process, it’s helpful to have a checklist for reference.

- So make sure your financials are accurate before closing the accounting period.

- Rounding out the month end closing procedure is the working papers phase.

One of the critical success drivers for any software deployment is user adoption through effective training. We created BlackLine U to ensure successful onboarding and continuous education, useful for both new customers and those expanding globally.

How to prepare for a smooth month end close process

The majority of the toughest portions of closing – data input, tracking down receipts – can now completely be automated using financial close software. Your accounting and finance teams know the rhythm of the business, such as when vendors pay invoices and when your company pays their expenses . Lean on these teams to set the timeline for overall review, including checking automated figures. While reviewers are noted throughout the process, Vasco schedules an overall review of the report around Day Six to account for any potential inaccuracies. Review all cash transactions and reconcile bank account balances to create a foundation for your financial statements, cash flow analysis, and any cash flow forecast. Finalize journal entries in your ERP and save credit card/bank statements for your records.

How do you close a book?

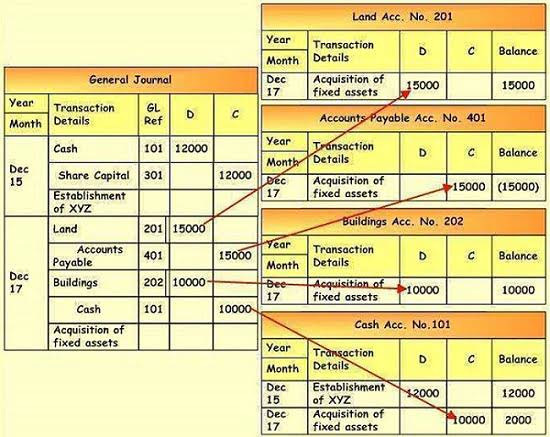

- Post entries to the general ledger.

- Total the general ledger accounts.

- Prepare a preliminary trial balance.

- Prepare adjusting journal entries.

- Foot the general ledger accounts again.

- Prepare an adjusted trial balance.

- Prepare financial statements.

- Prepare closing entries.

BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations. Accounting teams should review the monthly closing process, develop a checklist of tasks to ensure it goes smoothly and correctly, follow best practices, and use the software tools available to them.

How long should the month-end close process take?

Structure and automate intercompany transactions to maximize operational efficiency while improving deductibility and reducing tax leakage. Unify all compliance documentation, projects, and stakeholders in one globally accessible, cloud platform to maximize visibility. Link controls to related risks, narratives, and projects, and ensure version control. There are six main steps, but with an automation solution, you don’t have to worry about any of them. Plus, a tool like SolveXia allows for team members to make notes of any transaction that has been amended so that everyone is aware of the reasoning.

How do I create a group calendar in NetSuite?

To create a new shared calendar, Go to the Activities Tab > Create Event > in the Resources Tab Create a new Resource Group. To create a new Resource Group, select New at the bottom of the dropdown and add the employees you wish to share the calendar with.

Why rely on accountants to handle this tedious work when technology could do it instead – and better than ever. Being able to preempt any late tasks and having full visibility over the elements that are likely to have an impact on the deadline is critical. Gaining that company-wide visibility without automation relies on trawling through close checklists manually, which is neither efficient nor failsafe. The month-end close process can be messy and complex, with information from various systems and activities that need to be consolidated. Allow for close collaboration and track the completion of tasks by each team member to keep your company running smoothly. Confirm all transactions for the month including payroll, accounts payable, accounts receivable, and expense reports.

Expert Accounting Tips For Scaling Ecommerce

Tasks are often delayed in firms that lack automated capabilities due to a key stakeholder being on leave, or consistent delays on routine chores due to competing priorities. Take your time to enter all bills or or deposits, and link them to an invoice. From there, address expense account items not attached to a bill or invoice. Lump sum items like Use Tax and employee credit card transactions, are filed into their appropriate expense accounts and will not have corresponding vendor bills. If a company sells goods and has inventories, its monthly close will be more challenging.

- While this may seem straight forward, this is an area that can cause undue pain come month-end.

- Being able to preempt any late tasks and having full visibility over the elements that are likely to have an impact on the deadline is critical.

- A common sized income statement typically lists each line item as a percentage of net sales, which allows the reviewer to compare the current report to those of prior months.

- Other reconciliations include reconciling AP and AR balances to specific sub ledgers/aging reports, security deposit balances to specific tenants’ reports etc.

- If you use petty cash or have a petty cash fund, you need to account for those at month-end, too.

- The details and steps of the month end close process largely depend on the size of the company and the quantum of financial transactions executed per month.

- During this period, you must balance the account and check if all transactions have been recorded in the right amounts.

Technology can be used to capture all tasks and embed workflow and segregation of duties. Leading solutions also help centralize supporting documents and provide dashboards for reporting on status and KPI’s. Refocus your teams on analysis by replacing repetitive, spreadsheet-heavy work with leading-practice automation. Centralize data and close activities, automate journal entries and reconciliations, strengthen controls, and enhance visibility.

How to Get Procurement & Finance to Collaborate Well

Building the right month-end close process checklist helps your team break out of the reporting silo and into a more strategic seat in the business. At month-end close, review your revenue and expense accounts to confirm they are accurate. Check to see if you recorded month end closing process your expenses in the correct accounts for the period. Be sure that accruals and prepaid expenses are recorded accurately in your books. A month-end close is an accounting procedure that ensures all financial transactions have been accounted for in the previous month.

- It involves the consolidation, review and reconciliation of all financial information at the end of every month.

- And the best way to improve a process is to learn from what happened and improve it.

- Finally, it’s time to think ahead to the month in hand and create a business financial plan to address key risks.

- That way, you can keep your accounts payable in tip-top shape for your monthly close.

- And, your calendar can help you avoid falling behind on your books.

- Don’t leave the office for the day until the day’s goals are met.” She adds that it is helpful to participate in staff meetings to discuss timelines and deliverables so everyone understands expectations.

BlackLine and our ecosystem of software and cloud partners work together to transform our joint customers’ finance and accounting processes. Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company. Once you close your books, you can’t go back and create journal entries for that month. So make sure your financials are accurate before closing the accounting period.

Automate Repetitive Tasks in Your Month-End Close Process

Rounding out the month end closing procedure is the working papers phase. Working papers are your reference for the month end closing procedure. These papers show all adjustments and calculations as you reconcile all major accounts for the period. If https://www.bookstime.com/ everything is correct each Ledger results in a zero balance for the month end closing. Before you start adjusting, perform a flux analysis on the balance sheet and the P&L. Compare the accounts in the month you are closing with the previous month.

The frustration is further exacerbated by the high number of interdependencies to take into account. Some tasks need to be scheduled according to a date or time or need to be triggered by dependencies. Thanks to automation, there will be no need to constantly monitor each task and notify responsible individuals of the next steps. One of the most glaring issues well-known to business administrators is the inefficiency of gathering all the information needed. IRA Financial Reports reflecting financial information through the latest close are generally available the morning after the close is completed. A new Portal account can be requested by a colleague with access to the Support Portal.

The platform you select depends on the process and type of visibility you need. For instance, some platforms provide revision history, and keeping a good digital audit trail is vital for external and internal audit purposes. For instance, if closing AR took three days in the office, budget for additional time in a remote environment.

- Avoid bottlenecks, plan ahead, and easily see every task through to completion.

- Manual processes are also used in the approval process, and in many firms, executives need to sign off on manual paper copies, which are subsequently maintained for audit purposes.

- A misplaced invoice or statement can result in curious losses that you won’t be able to account for.

- You need to adjust properly, otherwise your starting balance for the next period will be off.

- If your business has a petty cash fund, it needs to be accounted for at month-end.

- It ensures the accuracy and timeliness of individual company’s numbers so they can be passed over to the group for consolidation and reporting and comply with regulatory reports – either internal or external.

- This process also facilitates financial and operational planning, and provides the basis for strategic business decision-making.